Financial Management Financial & Capital Structure

There are crucial things NRI should be aware of before investing in any property in the country within the FEMA. They must abide by the RBI guidelines for NRI investment in real estate. Money gets made in real estate investing when the property is acquired, not when it gets sold.

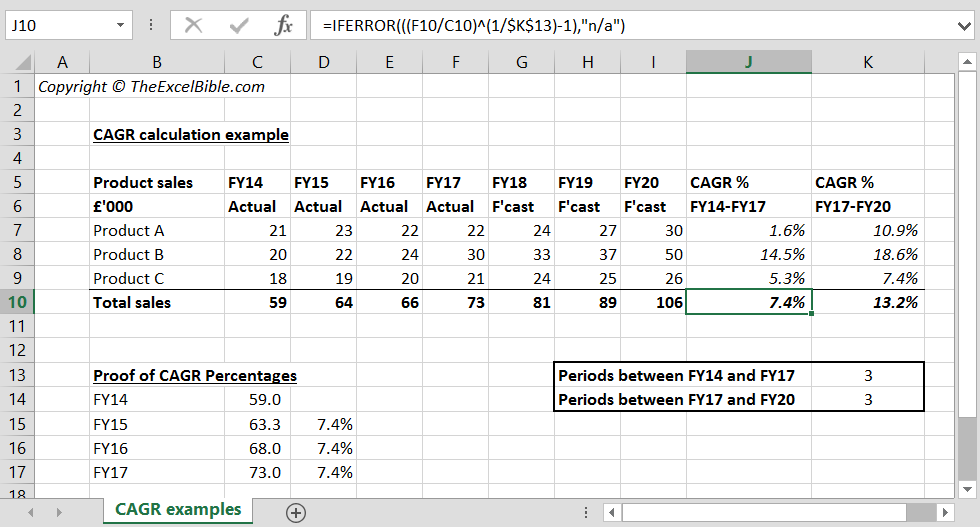

Total funds with Mr. X now is ` 11,000 ( ` 6000 own and ` 5000 borrowed). To buy 10% equity stake in firm U he needs only ` 10,000 (i.e. 10% of `1,00,000). Therefore after investing ` 10,000 in firm U he still has ` 1000 as gain.

Is Noi mandatory in Maharashtra?

Yes, it is mandatory to file an NoI while applying for a home loan. This document informs the registrar's office regarding the disbursement of a home loan.

Compute cost of equity of both the firms as per MM Hypothesis. Cost of debt is less than the cost of equity and both these costs are constant irrespective of the amount of debt capital used . Now value of equity is equal to the discounted value of income available for equity shareholders.

Factors Impacting The Value Of Property

Investors hoping for a safer option would therefore prefer properties with lower capitalization rates. The most important thing to remember is that you should never take more risks than you feel comfortable, and you should always use the capitalization rate in addition to other calculations. Calculating the capitalization rate is relatively easy if you have the net operating profit of the property.

- There are many ways to invest in real estate, of which the most prominent are residential real estate and commercial real estate.

- Also, nonrecurring gadgets such as money paid for a lawsuit settlement aren’t included.

- Property ownership is not always required for real estate investments.

- Gross profit is income minus all the expenses related to the production of items on the market, which is known as value of products sold .

- His current music video ‘NOI’ is produced by Sandeep Reddy and the song lyrics are penned by Imran Sastry.

- Passive income, consistent cash flow, tax advantages, diversification, and leverage are all advantages of investing in real estate.

Maximum cap rates in most locations range between 5 and 10%. Debt is cheaper source of finance and interest is also allowed expense as per tax. If cost of fixed fund is higher than rate of return then leverage work adversely. Therefore, it needs caution to plan the capital structure of a firm. According to this approach, capital structure decision is relevant to the value of the firm. An increase in financial leverage will lead to decline in the weighted average cost of capital , while the value of the firm as well as market price of ordinary share will increase.

Key Differences Between Net Income vs EBITDA

An additional return on investment of 2% may or may not be worth the additional risk inherent in the property. Perhaps you are able to secure favorable financing terms, and with this leverage, you can increase your return from 5% to 8%. If you are a more aggressive investor, this could be attractive to you.

What is the charges for notice of intimation in Pune?

The filing fee is Rs 1000/- irrespective of the Loan amount. In case of physical filing only (and not in the case of online filing), the document handling charges of Rs 300/- has to be paid.

As a result, firms utilize this to estimate the company’s earning capability to its utmost level. Operating income, on the other hand, is a GAAP-compliant figure that cannot be adjusted by the firms. While applying for a home loan, I was introduced to the NOI charges for home loan. However, the term Notice of intimation was quite new to me.

Question: What Is Excluded from Net Operating Income?

The new regulation, which became effective on April 1, 2013, aimed to stop real estate fraud, such as multiple registrations of the same home or multiple loans using the same asset as collateral. However, if the registration of the agreement is not done, then the mortgagee gets 30 days from the disbursement of the first loan amount, to file an NOI. Please read carefully and let me know if you need more information in the comments below. However, If no agreement is signed between the mortgagor and mortgagee, then the mortgagor has to file a notice of intimation.

According to NOI approach, there is no relationship between the cost of capital and value of the firm i.e. the value of the firm is independent of the capital structure of the firm. The NOI approach is definitional or conceptual and lacks behavioral significance. what is noi However, Modigliani-Miller approach provides behavioural justification for constant overall cost of capital and therefore, total value of the firm. In case of Firm U, the cost of equity will be same as cost of capital because of zero debts.

Here we are given that the firms are identical except capital structure. Due to debt capital the value of levered firm is higher by ` 10,000. The value of firm U is ` 1,00,000 which is all equity capital. The value of firm L is ` 1,10,000 which comprises of ` 50,000 as value of debt capital and ` 60,000 (i.e. ` 1,10,000 – ` 50,000) as value of equity capital. Therefore an investor’s value of equity capital is higher in firm L. Therefore rational investors will start arbitrage until the values of both the firms become equal.

If you pay in cash for a property, your cash flow is exactly the NOI. It is so because it is the maximum cash flow of the property. The expected Earnings before interest and taxes of a firm is ` 4,00,000. It has issued equity share capital and the cost of equity is assumed to be 10%. Find out the value of firm and overall cost of capital as per Net Income Approach. Property rental valuation is important for making investment decisions and renting out the property at a better price.

Hanoi Air Quality Index (AQI)

For example, what happens if the growth rate is equal to the discount rate? Alternatively, if the growth rate exceeds the discount rate, the Gordon model provides a negative assessment, which is also an absurd result. The main difference between the capitalization rate and the return on investment is what both measures are used for. As I have already indicated, the capitalization rate estimates the potential return on investment of the investor. That said, it`s not hard to understand why many entrepreneurs confuse the two.

Along with the criticism of EBIT and EBITDA, the EBIDA figure does not include other key info, corresponding to working capital adjustments and capital expenditures . This can embrace many nonprofits, similar to non-for-revenue hospitals or charity and spiritual organizations. Non-working expenses are recorded on the bottom of a company’s earnings assertion. 2) If the properties are situated within the different Registration Jurisdiction, then the separate notices have to be filed to the every Sub Registrar of whose jurisdiction the property is situated. For such notices, the filing fees and document handling charges have to be paid separately. EBITDA is calculated by multiplying EBIT by amortization and depreciation.

When evaluating the efficacy of a company’s cost-cutting measures, calculating its EBITDA margin is useful. The smaller a company’s operational expenditures are in proportion to overall revenue, the better its EBITDA margin. EBITDA is widely used because it can be used for businesses of various sizes. Operating income, on the other hand, is money derived from operations. The portion of revenue from other sources is the fundamental difference between operational income and net income.

It may also be computed by combining net profit with interest, taxes, depreciation, and amortization. On the other side, operational income is computed by deducting operating expenditures from gross revenue. I completely agree with Kamal’s answer about the notice of intimation charges in home loan. Just to reiterate, I’d say that as Kamal said, any loan amount would incur a 1000 Rupees Notice of Intimation fee if submitted online.

You must invest early for retirement through the investment options. FDI is not authorized in a company that is or intends to be in the real estate business, farmhouse building, or dealing in transferable development rights. You cannot foretell the future, but a thorough approach to researching an investment opportunity can help you evaluate objectively and confidently if a property is suited for you and your goals. As per Savills World Research, the valuation of global real estate at the end of 2017 got projected to be $280.6 trillion.

Remember to calculate the NOI and deduct all property-related expenses, without mortgage interest, depreciation and amortization, from property income. Once the estimated value is calculated, the owner can determine whether refinancing is possible or even useful. Is it a good decision to buy back your Treasuries and invest in an office building with an acquisition cap of 5%?

To calculate the exact value of the property, it is necessary to analyze the location as well as receive proper guidance. The value of a property keeps changing, hence, it is important to calculate the value of a property periodically. Visas Avenue Immigration is thebest Visa consultant in India for Canada PRprocess. It helps hundreds of visa applicants every year to get a permanent residency Visa approval for Canada with an impressive success rate of more than 90 %. If you want to apply in the most appropriate PNP this year, you require preparing your immigration file in advance to apply first in the relevant program.

FAQ 1. What is Net Operating income theory of capital structure?

Gross potential income is the amount that would be earned if your property operated at full capacity every day of the year in an ideal world. Real-world renters move out, get fired, or have financial difficulties, among other causes, leaving homes partially vacant. You can subtract these losses from the gross potential income to arrive at gross operating income if all or a portion of your property is vacant. Capital structure refers to the combination of funds from different sources of finance. Company can arrange funds through equity share capital, retained earnings, preference share capital and long term debts.

Capital structure is the combination of capitals from different sources of finance. The replacement cost is the money that can be used to construct an exact similar property. The cost will include similar land value, labour cost, and material cost. When the size of the property, age, number of rooms, and other factors are similar to the compared property, then it gets easier to figure out the comparison. The value of the property will include the cost of building construction subtracting the depreciation of the existing property and adding the cost of the land. When you are owning a property, you can apply for a mortgage in an emergency.

What is NOI fees in Maharashtra?

Notice of intimation Maharashtra charges if filed online is Rs 1000, whatever the loan amount may be. If Notice of intimation is filed physically by going to the SRO office, the Notice of intimation Maharashtra charges or the document handling charge will be Rs 300.

この記事へのコメントはありません。